Looking to boost your money skills? Getting to know the HSBC Credit Card application process is key.

These cards offer lots of perks like rewards, cash back, and a chance to build a good credit score.

This article will guide you on how to apply for an HSBC Credit Card.

You’ll get to know all the steps and what you need to qualify.

This prepares you for a bright financial future.

Key Takeaways

- Understand the benefits of HSBC Credit Cards.

- Know the eligibility requirements before applying.

- Gather necessary documents for a smooth application process.

- Learn how to apply for an HSBC Credit Card online.

- Explore various features of HSBC Credit Cards.

- Start your application journey today and enhance your financial power.

Introduction to HSBC Credit Cards

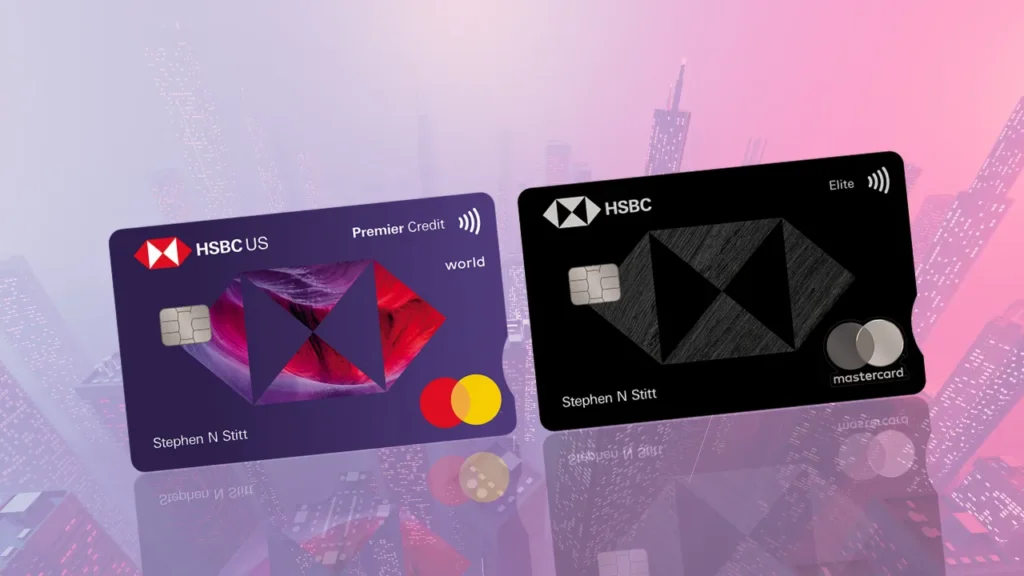

HSBC Credit Cards come in many forms to suit your needs. You can choose from options like the HSBC Gold Mastercard and the HSBC Cash Rewards Mastercard. Each one has special features for different spending habits and likes.

HSBC Credit Cards offer great benefits. You get cash back, travel benefits, and good interest rates. Having an HSBC card also gives you online banking access. This makes managing your account easy. Plus, you get fraud protection and special deals.

Knowing about the different HSBC Credit Cards and their perks helps you pick the right one. This way, you can match it with your money goals.

Eligibility Requirements for HSBC Credit Card

To get an HSBC Credit Card, it’s key to know what they require. You need to have a good credit score and earn enough income. Generally, a credit score of 680 or more is needed. This shows HSBC if you’re likely to pay back what you owe.

Your income is also important for the application. HSBC wants to make sure you earn enough to pay off the card. So, you’ll need to show proof of how much you make.

Lastly, where you live matters too. You should be living in the U.S. as a citizen or a permanent resident. If you meet these conditions, your card application has a better chance of success.

Documents Needed to Apply for an HSBC Credit Card

Before you apply for an HSBC Credit Card, make sure to gather all the needed documents. These documents prove that you’re eligible. Having your HSBC Credit Card application documents ready makes the process easier.

For your application, you must have a government-issued ID, like a driver’s license or a passport. These help confirm who you are and are important for the bank.

Your application also needs to show you have a stable income. You can do this with recent pay stubs or tax returns. Income verification shows HSBC you can pay back what you owe.

You will also need to show where you live. Do this by providing utility bills or rental agreements with your name and address. This keeps all your details current and correct.

| Document Type | Description |

|---|---|

| Government-Issued ID | A driver’s license or passport used for identity verification. |

| Proof of Income | Recent pay stubs or tax returns for income verification. |

| Proof of Residency | Utility bills or rental agreements confirming your address. |

Get these important documents ready before applying to make your HSBC Credit Card application go smoothly.

How to Apply for a HSBC Credit Card Online

Applying for a HSBC Credit Card online is easy and quick. First, go to the HSBC official website. There, you’ll find different credit cards to match your needs.

Choose the card that fits you best. Each one has its own benefits and features. Review them carefully before deciding. Then, start the HSBC online application.

You will need to fill out the online form. Give correct info about yourself, your money situation, and job. Make sure you fill all necessary fields right to avoid delays.

You may have to upload some documents. These could be things like your ID and proof of income. Do this if the card you’re applying for needs it. After that, submit your application.

The following table outlines key steps in the HSBC website application:

| Step | Description |

|---|---|

| 1 | Visit the HSBC website to explore credit card options. |

| 2 | Select the credit card that fits your needs. |

| 3 | Complete the online application form with accurate details. |

| 4 | Submit required documents as part of the application. |

| 5 | Submit your application and await the decision. |

Following these steps makes it easy to apply for an HSBC Credit Card online. Use the simple website to complete your application. This way, you can quickly get the benefits of HSBC credit cards.

Understanding HSBC Credit Card Features

HSBC Credit Cards have benefits for everyone. Rewards programs let you get cash back on what you buy. Or, you can collect points for trips if you love to travel. Travel-focused cards even offer free airport lounge access and travel insurance to make your journeys better.

Different HSBC cards have different annual percentage rates (APR). So, you can pick one that fits your budget. A lower APR is great if you sometimes have a balance. It helps reduce the interest you pay over time.

HSBC cares about helping its customers too. You can use their easy online platform to manage your account. It lets you pay bills, check your balance, and see your rewards easily. Knowing these features can help you get the most out of your HSBC Credit Card.

Apply Today for Your HSBC Credit Card

Looking to boost your financial flexibility? Now’s the perfect time to apply for an HSBC Credit Card. The online application lets you get quick feedback on your status. This makes the whole process fast and simple.

There are plenty of reasons to apply today. You’ll get features that match how you spend and live. Enjoy cashback, travel perks, and special promotions. Applying for an HSBC Credit Card now means making the most of these benefits.

Want to manage your money better? It’s easy with just a few clicks. Don’t miss this chance to enhance your buying power. Apply now and see all the benefits an HSBC Credit Card offers.

By clicking the button you will be redirected to another website.

Conclusion

In summary, HSBC Credit Cards offer many benefits that can help with your finances. Whether you want to build your credit or get rewards, these cards are helpful. The requirements to apply are clear, helping you get ready. They also make sure you have all you need to start your application.

Think about how an HSBC Credit Card fits with your money goals and spending style. Such a card is a key way to handle your money better. You get to enjoy benefits that can majorly boost your financial health.

Always look at the HSBC website for the latest updates and policy changes. This ensures you have the newest info for your application. Making well-informed choices is crucial for meeting your financial needs.

FAQ

What are the different types of HSBC Credit Cards available?

HSBC offers a variety of credit cards tailored to different consumer needs, including the HSBC Gold Mastercard for low-interest rates, the HSBC Cash Rewards Mastercard for cash back on purchases, and the HSBC Premier World Elite Mastercard for exclusive travel benefits.

What are the eligibility requirements for applying for an HSBC Credit Card?

To get an HSBC Credit Card, you usually need a minimum 680 credit score, stable income, and U.S. citizenship or permanent residency. These requirements help HSBC check if you can handle credit well.

What documents will I need to apply for an HSBC Credit Card?

When you apply for an HSBC Credit Card, you need to provide some documents. These include a government-issued ID (like a driver’s license or passport). You also need your Social Security number, proof of income (like pay stubs), and proof of where you live (like bills or a lease).

How do I apply for an HSBC Credit Card online?

You can apply online for an HSBC Credit Card by going to the HSBC website. Choose the card that fits your needs best and fill out the form carefully. Make sure all the needed info is correct.

What features and benefits are offered with HSBC Credit Cards?

HSBC Credit Cards offer a bunch of cool features. You can get cash back on stuff you buy, travel perks, and no extra charges for using your card abroad on some cards. You might also find good rates, different fees, and handy online tools for looking after your account.

Why should I consider applying for an HSBC Credit Card today?

Getting an HSBC Credit Card today gives you a lot of financial benefits. You’ll find out quickly if you’re approved and can manage your account online easily. A credit card gives you more ways to buy things and more financial freedom.